Get Exciting Cashback with Bajaj Finserv Doctor Loan this Loan Utsav

Jul 30, 2025

NewsVoir

Pune (Maharashtra) [India], July 30: Running a medical practice in today's fast-changing healthcare environment is no easy task. Whether it is setting up a new clinic, upgrading diagnostic equipment, expanding practice, or simply managing day-to-day working capital--funding can often become a challenge. With rising costs and growing patient expectations, even experienced doctors may feel the financial strain.

Bajaj Finserv Doctor Loan is a suitable option medical professionals can consider to get over these challenges. This offering is designed specifically for healthcare professionals, providing high-value, unsecured loans to meet their professional needs without the hassle of lengthy paperwork or collateral.

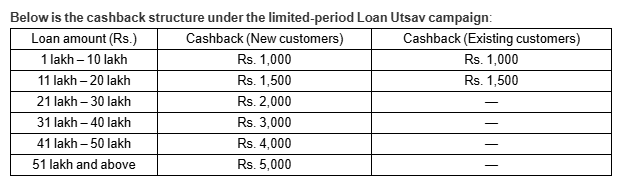

And to make it even more rewarding, Bajaj Finance has launched an exclusive Loan Utsav campaign featuring special cashback offers. Available from 1st July to 31st July 2025, the offer is open to the first 50 doctors who apply through the Bajaj Finserv App or website and get their loan disbursed during the campaign period. Eligible medical professionals stand to receive up to Rs. 5,000 in cashback rewards, making it a timely opportunity to invest in.

The cashback will be credited to the customer's Bajaj Pay Wallet. If no active wallet exists, rewards will be given as Bajaj Coins, redeemable on the Bajaj Finserv App.

How to apply for Bajaj Finserv Doctor Loan

Bajaj Finance offers a simple and quick loan application process for medical professionals. Here's how to apply for the Bajaj Finserv Doctor Loan through the app:

* Download the Bajaj Finserv App from the Google Play Store.

* Log in using mobile number.

* On the home screen, select the "Doctor Loan" icon.

* Tap the "CHECK ELIGIBILITY" button.

* Complete the application form with basic personal and professional information.

* After filling the form, tap "CONTINUE".

* Provide banking details as requested.

* Submit application for processing.

To apply via the Bajaj Finserv website, follow these steps:

* Visit the official Bajaj Finserv website.

* Go to the doctor loan page and click on the "CHECK ELIGIBILITY" button.

* Fill in personal and professional details on the application form.

* After completing the form, click "CONTINUE".

* Enter banking information as required.

* Verify registered address and other KYC details.

* Submit application for processing.

Why choose Bajaj Finserv Doctor Loan?

Choosing the right financial support is crucial for medical professionals looking to expand their practice, upgrade equipment, or manage daily operational costs. The Bajaj Finserv Doctor Loan is designed specifically to meet the unique needs of doctors, offering benefits such as:

* Loans up to Rs. 80 lakh: Whether it is setting up a new clinic, purchasing advanced medical equipment, or expanding existing practice, the Bajaj Finserv Doctor Loan offers substantial funding of up to Rs. 80 lakh. This high loan amount is specifically designed to cater to the diverse financial needs of doctors, ensuring they have adequate capital to support professional goals.

* No collateral required: One of the biggest advantages of this loan is that it does not require any collateral or security. This means doctors can apply and receive funds without the hassle of pledging assets, saving time and avoiding unnecessary complications.

* Quick approval and disbursal: Time is often critical for medical professionals who need prompt financial assistance. Bajaj Finance ensures fast loan processing and disbursal, often within 48 hours*, allowing quicker access to funds without delay.

* Flexible repayment tenure: Understanding that every doctor's financial situation is different, this loan offers flexible repayment options. One can choose a repayment tenure that suits their cash flow and working capital cycle, ranging from 1 year up to 8 years. This flexibility helps manage repayments comfortably while focusing on operations.

* Online application process through app or website: The loan application and management process is digital, allowing one to apply from anywhere using the Bajaj Finserv App or website. This eliminates the need for physical visits, lengthy documentation, and reduces processing time, making the experience smooth and hassle-free for busy medical professionals.

These doctor loan features make this offering by Bajaj Finance an ideal financial solution for doctors.

For any medical professional looking to expand operations, Loan Utsav presents the perfect chance to access funding and earn exclusive rewards. Don't miss out--apply today and unlock cashback of up to Rs. 5,000.

Bajaj Finance Ltd. ('BFL', 'Bajaj Finance', or 'the Company'), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 69.14 million customers. BFL has the highest domestic credit rating of AAA/Stable for long-term borrowing, A1+ for short-term borrowing, and CRISIL AAA/Stable & [ICRA]AAA(Stable) for its FD program. It has a long-term issuer credit rating of BB+/Positive and a short-term rating of B by S&P Global ratings. To know more, visit www.bajajfinserv.in

*Terms and conditions apply

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)